are dental implants tax deductible in canada

For example if your insurance covers 80 of. Small business owners in Canada can take advantage of a Health Spending Account HSA to turn dental implant costs into a pre-tax expense through their corporation.

Cost Of Ceramic Dental Implants

Most business owners are unaware of this plan.

. For example if your insurance covers 80 of. Up to 15 cash back Are dental implants tax deductable in Canada. Yes Invisalign is tax deductible in Canada.

You can claim the portion of the procedure that you pay also known as the co-pay. Yes the dental implant is a medical expense deductible as an itemized deduction on Schedule A. Tax laws vary by country as all laws do.

You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return. Taxes on your gross income are deductible by 5. Your dental implant expenses are tax-deductible in the United States per IRS guidelines clearly stating that payments made for artificial teeth qualify.

To help you with this cost the canada revenue agency allows dental expenses to be used as medical. 1 Follow along as we. The good news is yes dental implants.

Only the expense that you paid with out of pocket. Invisalign treatment qualifies as a dental service and so is eligible as a medical expense to be used as a tax deduction. Taxes on your gross income are deductible by 5.

Can i deduct my health insurance premiums 2020. Medical costs deduction in Canada since 2010 have not allowed for cosmetic procedures. Yes you can take a dental tax deduction for most of the costs associated with non-cosmetic dental expenses for you and your family but only to a certain percentage of your.

To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. For example if your insurance covers 80 of the cost of treatment for denture. 22 2022 published 512 am.

You can claim paid Invisalign. The CRA had provided examples of expenses incurred for purely aesthetic. Are Dental Implants Income Tax Deductible.

Yes dental implants are an approved medical expense that can be deducted on your return. January 22 2021 349 PM. Tax laws vary by country as all laws do.

Dental expenses includes fillings. Even if you have insurance coverage that includes implant treatment you could still receive a tax credit. I am 79 years of age with no dependants other than my - Answered by a verified Canadian Tax Expert.

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

How Much For Dental Implants In Canada

Dental Implant Cost In Gurgaon India 2022 Update Dantkriti Dental Clinic

Is Teeth Whitening For Me Victoria Village Dentistry

Pdf Imp Lant Denti Stry N The Estheti C Zone Key Principles For Functional And Esthetically Viable Implant Restoration Semantic Scholar

Dental Implant Live Patient Program Itc Seminars

Dental Implant Cost Near Me Clear Choice Cost Maryland

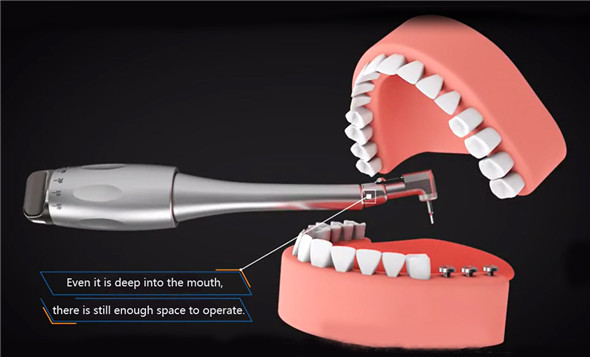

Dental Implant Torque Control Universal Torque Wrench Right Angle Variable Torque Wrench Driver Universal Implant Torque Treedental Treedental

Dental Crown Cost How Much Is A Tooth Crown Porcelain 2022

What Is The Cost Of Dental Implants In Canada

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

Surgical Extractions Courses Live Patient Program Itc Seminars

Dental Implant Cost Costa Mesa How Much Does Single Tooth Implant Cost In Orange County Dentistry At Its Finest

Dental Impant Grants Everything You Need To Know In 2021